You don’t need to be a trained economist to know that the model of economics the world uses and the way economics is revered like work of the gods today is wrong.

In fact, it is probably better if you aren’t, and that you aren’t involved in economics, banking or corporate wealth creation either. As you are much more likely to be objective and untainted by ‘being in the tent’ in some way.

The misplaced ingenuity of the economic system and how it works has made it as complex as it is mind boggling. But that doesn’t give any surety or guarantee that how it works and what it achieves is in any way good.

For those actually thinking about why money is the common factor in everything across the world that is now going wrong, the complexity of the economic system is being exposed to light as the smokescreen that it is giving the hallucination of credibility to all the darkness and malevolence that has been so cleverly hidden within.

How can something so clever and complex not be real, is a question that many would employ as a riposte to counter the suggestion that there is absolutely no legitimacy to the FIAT monetary system, MMT, Free Markets, Globalisation and Neoliberal Orthodoxy that we have been subjected to for 5 decades or more.

But isn’t it the case that any good game that feels good to play is only good for those playing, because of the complexities and therefore levels for ‘the players’ that are involved?

How many carrots does it cost to buy a wheel?

To really understand why the world now has got the relationship with money so wrong – even though it was deliberately made this way by corrupt interests who have changed the laws so that their crimes have been legitimised and wiped clean – we really do need to stop for a moment, count to ten and think about what money is, or rather was really intended for.

In so far as the accepted narrative of human history goes, the whole pathway of our development has been progress that moved towards today in a linear fashion, stepping off from very primitive times when man couldn’t even speak, let alone farm for food.

The point here is not to argue whether or not any accepted version of the evolution of man is true. But to set the first picture back at a point when everything was considerably more simple. Long before more and more of those complex ideas or complexities became involved in how people trade.

Then, as now; different people did different things and produced different foods, goods and services to others as the direct result of whatever it was that they did.

For the purposes of this explanation, let’s assume that there are already fishers, farmers, growers, millers, bakers, saddlers, farriers, blacksmiths, cheese and butter makers, butchers, water carriers and pretty much someone or some small business providing all the different forms of foods, goods and services that we need to provide for life, from around a village green.

Some days a baker doesn’t want fish and a fisher certainly doesn’t want a saddle or leather goods daily. Even though they probably need something made to protect them against the elements from time to time.

However, everyone needs something regularly. Whether it’s for their own consumption, or it’s there to help them complete and provide output or goods from their own work.

Bartering and exchange, or swapping goods or even hours of work are of course a very straightforward and sensible way for two parties to make a transaction when one has something available that the other needs.

But the real benefit of bartering and exchange comes from being localised. And its weakness soon showed when the transactions were required to take place over distance, or for items – like that saddle or something equally special – which in day-to-day terms, are rather obscure.

Money, or coins of some kind used at first, created a transactional value, or to be more accurate, a medium of exchange.

The creation of a medium of exchange meant that one person’s goods or efforts could be exchanged for coins that could then be exchanged for whatever that person wanted themselves. All without there being any excessive delays or the need for a very complex or convoluted chain of different transactions to be involved.

The beauty of the system, at that point, was that the money in use could only relate to the agreed value of the transaction.

It would have been good for everyone, once the related practicalities involved were ironed out, if that system had continued without further ‘progress’. The relationship we all have with money could then have remained the same in relative terms – as that unit of exchange and nothing more.

Unfortunately for mankind, progress very quickly created wealth disparity or what we call wealth inequality today.

This imbalance was itself made progressively worse by the inter-generational transfer of property and wealth (and the power it buys) which has snowballed over time. Quite literally meaning that people can be advantaged or disadvantaged by birth, even before any one of the many other factors that skew life opportunities can come into view.

One of the most unfortunate elements of the human condition is the innate desire to always possess and accumulate more. For no better reason than the basic fear we all have of experiencing lack. With the rather perverse dimension that those who have more guard it more jealously than others, probably because they believe they have much more to lose.

The power and influence that money has given people who really weren’t fit to have the responsibility they had over the lives of others, has only got worse over time.

As industry and technology has improved and made it easier and easier to avoid genuine consideration for the consequences of their actions upon others, the human cost has become increasingly irrelevant, whenever the opportunity to make more profit was involved.

When promissory notes or what we know as cash came into being, a giant leap forward was taken towards the system that we have now, where the accepted wisdom is that the value of the money – or what we are agreeing to exchange as being representative of money – is being exchanged under a mutual understanding of trust, that is shared across society, and not just between the people where the specific transactions are involved.

Trust is of course belief. And as those with power and influence at the centre of the banking system realised that having currencies pinned or anchored to anything meant that they could only ever use or suggest they were able to use the money or sensible multiples of the money that they knew they either held, were owed or could earn within a certain time frame, they knew that they would have to create a new system that would release these chains. So that in terms of the money that they could create and use in the future, the only restraints would be dictated by them.

We should be under no illusion that this process of creating an economic system that could lead to limitless wealth and the control of everything for those who controlled it, wasn’t a plan that developed overnight.

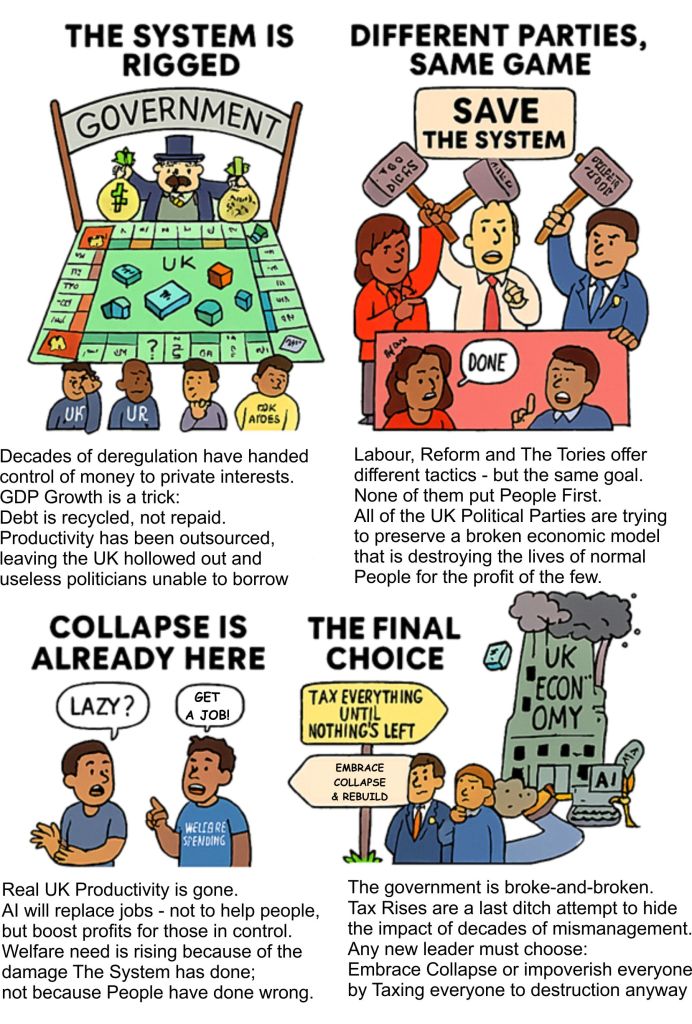

The economic system that we have today was created and implemented over decades and carefully constructed so that it would make life much easier for the interests and in particular the politicians who needed to be bought. So that the useful idiots who gained power under the illusion of democracy would obligingly pave the way with system changes that have legitimised this otherwise criminal system at every step of the way therein.

When everything is about money, the answers to every question can only be found in monetary terms.

The money we have today and the way that it comes to and is taken from us – the economy – is the direct result and design of this massive, corrupt and inhuman game that the worlds wealthy, powerful and influential – the elites, decided to play.

The money we have in our pockets, bank accounts and have the ability to earn changes value quickly at the will or as a result of the actions of others.

Meanwhile, the direction of travel for the general population has always been that we are and always would become increasingly poor, as the value of the money which is typically what the poorest in society have only been able to hold, decreases faster than the rate at which our skills and experience develop or there is any chance to earn more so that we can keep up with or counteract the fall.

It was always intended to be this way. As those with wealth always knew that the real wealth was the control of assets and anything and everything that could then rented out to everyone. All as the world became increasingly poorer and their ability to grow control and rent out everything the money they created had bought them gave them even more.

It is ironic that billionaires now have so many zeros on their balance sheets. As everyone who has been a victim of what is probably mankind’s greatest con is now beginning to realise that they have been left with zero. Or if they are lucky, a diminishing amount of liquid capital that isn’t worth a lot more.

I would like to add at this stage that this essay is not an attack on any individual for whatever it is that they may believe they possess, control or have influence over today. Many of those with excessive wealth, power and influence today have just played along with the rules of a very clever game. One that has removed the balance, Justice and morality from every part of life and has done it so successfully that the poison it has replaced values with is embedded across cultures and normal life to the point that even the academics and leaders in finance and economics believe in the legitimacy and correctness of an entire system which is bewilderingly anti-human at its very core.

In simple terms

The simplicity of the mechanics of an economic system and more specifically a monetary system that revolves around private banks creating money from nothing – a process which is carefully hidden from view – so that government always looks like it is borrowing or rather selling bonds to private interests to finance everything, whilst those banks also lend money that doesn’t exist to us through loans, finance, credit cards and even pay day loans, really do make it horrendously difficult to accept that this is one massive confidence scam. Especially as everything is hidden in plain sight by little more than the disinterest that we typically have in anything that goes beyond having our perceived needs met.

However, let’s think about it as if we were reading a story about two friends at the start of their working lives; one with the motivation to work hard and deliver through their own industry, whilst the other has had life easy and just wants to find another easy way to get more, and we can then perhaps see how this gargantuan scam rolls out when exposed to light.

The diligent and easy living friends talk one day, looking at property that they would both like to own.

The diligent friend commits to working hard and earning the money to buy what they would like to own and leaves, promising to catch up when this outcome has been achieved.

Meanwhile, the easy living friend knows that he has the contacts and ideas necessary to go away and print enough of the money he needs to buy that same property today. And that he can do this from nothing, which will work out well for him but not his friend, so long as he doesn’t speak openly about what he’s doing. Uses his contacts to change a few rules so that what he’s doing is legal. And he doesn’t keep printing more money to buy everything else so that it becomes obvious what he’s been doing all along. Afterall, nobody will know if he uses the money he then earns from renting out that property to pay all that money back…

The money that the easy living friend has created, has just increased the amount of money that exists.

This means that because there isn’t actually any more property, production or anything else with ‘real’ value that corresponds to the increasing pool of money, all of the money that’s available is now worth much less than it was.

The real world impact of this fantasy being made reality is that the diligent friend will have to worker harder, longer or both, to pay for the property that the easy living friend has just taken without effort.

What is more, the easy living friend is now offering to rent the property he’s bought to the diligent friend who now realises that he may never be able to afford to buy it.

If you can see and understand the basic mechanics of how this situation works, you only need scale up the same principles to understand how the massive, growing amount of money – and the ridiculous inflation and the growing cost of living problem we are all facing, has been created and is now growing at a ridiculous rate.

It is an unavoidable, inescapable fact that if one person or set of people are able to buy real, tangible things that have value to us – whatever those things might be – with money that doesn’t actually exist, they can take lawful possession of those things and do with them whatever they so choose – as any legitimate owner would be able to do so.

However, the illegitimate creation of the money and the legitimised theft of assets, businesses, infrastructure and everything else imaginable that it has financed means what they have been doing is just one part of a multifaceted crime against everyone else.

The crimes that follow the created money pathways include the impoverishment of the masses.

Yet they become even worse when we consider that public services and infrastructure such as utility companies have been bought up with fake money.

Entire business sectors like the pub trade and small, local shops have also all become unviable because fake money has financed industry expansion of big retail and all their centralised supply chains, that would not otherwise have been possible.

To cap that all off, markets and the practices of big business and finance have been deregulated through the drive for ‘Free Markets’. So that those making money can make more and more, because the rules that once protected us all and small independent businesses have been removed, whilst regulations that cost us, exclude us and disqualify us from our own independence and from taking part have instead been imposed under the pretence that they help and protect us.

The whole pathway of illegitimate money creation using the FIAT system leads or rather has led to the doorstep of nothing less than worldwide system control.

The only thing that now gives us the opportunity to save ourselves from a very challenging fate is the reality that those with their hands in the till have already broken too many of the rules of their own game.

The whole system is starting to collapse before the great reset or imposition of the next new world order has conclusively been imposed.

The Future of Money

I could stop there. But in lifting the stone or exposing what lies beneath it to light I am certainly not alone.

Before continuing further, I would encourage anyone who has read this far to do their own research and use as many different sources and mediums as they can to uncover and draw their own conclusions about all of this and what is really going on.

My real interest and passion is what happens next for us and for our future. Once we have got through this horrid time and whatever turbulence and challenges that we now face, once we have got to the other side and left them all behind.

Whilst I have written extensively about what a good working model for our future society would look like in Our Local Future, I have also spent time sharing thoughts and ideas about the way money and commerce would work, in books from Levelling Level, to An Economy for the Common Good and The Basic Living Standard too.

What we should perhaps all be able to conclude – once we have dealt with our own addictions and attachment to the way that endless money supposedly works for us all now – is that money should never hold its own value. Should never be speculated upon, and the power of its creation and policing should never be under private control.

What is more, the value of legal currency should never be pinned to anything that can itself vary in value, especially when whatever that currency is pinned to is in short supply or can be controlled manipulatively or otherwise at will.

People are the only legitimate economic constant

If everyone did what they do, only took what they need and were happy to share or exchange what they didn’t with whoever needed it in return for something they did in return, there would never be need of money of any kind, ever again.

Whilst I can see that to many the idea that everyone just does what they do today for nothing and that in return, they get just enough of what they need of everything else in return might seem fanciful, this suggestion does nonetheless make a very important point about everyone only taking or expecting to have access to what they actually need.

Need is NOT the same thing as want.

Too much want is what has led to a situation where there are people right across the world today who don’t have access just to the things that they need.

An economy – a legitimate economy – will function only to provide for the needs of people within it.

There isn’t an argument that can counter this legitimately. Any argument made against this, no matter how compelling or well elucidated, is inevitably built upon one person being able to obtain or accumulate more things than others. Because the alternative system favours their interests more.

These are the fundamental basics of greed.

Locality based economies and economics

Everyone who can, should play their part or contribute to the function of a legitimate economy, in whatever role they are able. So that everyone who is active, then comes together to become the sum of all the parts – with the sum of those parts being the community, which because of what members can do together collaboratively, will be greater than what everyone would be able to do by working alone.

The value of a legitimate economy should therefore be based upon the number of people who are active within it and include what they input or contribute to that economy individually and therefore collectively.

If every member of the community does what they should be doing, and the needs of everyone being met are always prioritised and planned for or budgeted for as they should be, the whole system will move closely towards self-containment, with the amount of money in circulation always being closely related to the number of heads within the population.

A localised and online local market exchange system that focuses on bartering and exchange for foods, goods, services and work being made universally available alongside cash and digitally transferable money, should also exist so that everything works in a circular fashion and everyone’s particular needs are always met in ways that favour everyone.

The needs for public service, infrastructure, community activities and everything beyond should be met by everyone who is able to work volunteering the equivalent of 1/10 of their working week and their skills or experience to the community. Thereby meeting whatever needs and community income generation requirement there may then be.

Excess goods produced, surplus service capacity and over production which is specialist to the community would also be traded with other communities and traded where any additional requirements beyond the scope of community production exist.

The blight of greed-driven thinking

The only reason that an economic system that will work like this, which promotes freedom and financial independence of the masses, would not work, is because those who would no longer be able to define themselves as being different to others through the accumulation of additional and unnecessary wealth will argue that it isn’t practical and cannot work.

Even within a genuinely egalitarian approach to economics based along these lines, it is a fact that some could always do better, because they choose to do so through their own industry. Whilst many others – and the majority at that, would be happy to just make the contribution that was absolutely necessary, knowing that they would be happy, healthy, safe and secure because all of their basic and essential needs were being met.

It is part of the capitalist myth that entrepreneurialism and creativity in commerce cannot exist when the ability to earn or rather profit is capped.

The real truth of the matter is that everyone will be productive and make a valuable contribution when anything that goes beyond what it takes to look after themselves and those who depend on them is a choice and the ability to just live a normal life without dependency on anything beyond themselves hasn’t been denied by the actions of others.

Nobody has the right to take or have more than they need and certainly not when it can only come to them through the exploitation and infliction of pain and suffering of any kind upon others.

Further Reading (Updated 14/1/26):

1. Breaking the Money Myth: Rethinking Value, Exchange and Equality

https://adamtugwell.blog/2025/11/12/breaking-the-money-myth-rethinking-value-exchange-and-equality/

Summary:

Challenges conventional beliefs about money, exploring how value and exchange have been distorted by modern economic systems. This article lays the groundwork for understanding why current monetary practices are problematic and why rethinking these fundamentals is essential for a fairer society.

2. The Basic Living Standard Explained

https://adamtugwell.blog/2025/10/24/the-basic-living-standard-explained/

Summary:

Explains the concept of a “basic living standard” – the minimum requirements for a dignified life. It discusses how economies should prioritise meeting everyone’s essential needs, and why this principle is central to building a legitimate, people-focused economy.

3. An Economy for the Common Good (Full Text)

https://adamtugwell.blog/2025/02/24/an-economy-for-the-common-good-full-text/

Summary:

Presents a comprehensive vision for an economy designed to serve the common good, rather than private interests. It explores practical models and policies that could shift economic priorities toward collective wellbeing and sustainability.

4. The Role of Barter and Exchange in the Local Economy Governance System

https://adamtugwell.blog/2025/12/03/the-role-of-barter-and-exchange-in-the-local-economy-governance-system/

Summary:

Delves into how barter and local exchange systems can strengthen community resilience and independence. Offers practical insights into alternative economic mechanisms that bypass traditional currency, supporting the idea of locality-based economies.

5. The Local Economy Governance System (Online Text)

https://adamtugwell.blog/2025/11/21/the-local-economy-governance-system-online-text/

Summary:

Provides a detailed framework for governing local economies, emphasizing community participation, transparency, and sustainability. Ties together previous concepts, showing how they can be implemented at the local level for maximum impact.